Despite a ton of budgeting apps out on the market, most are just trackers and few are actively helping users to actually improve their financial health.

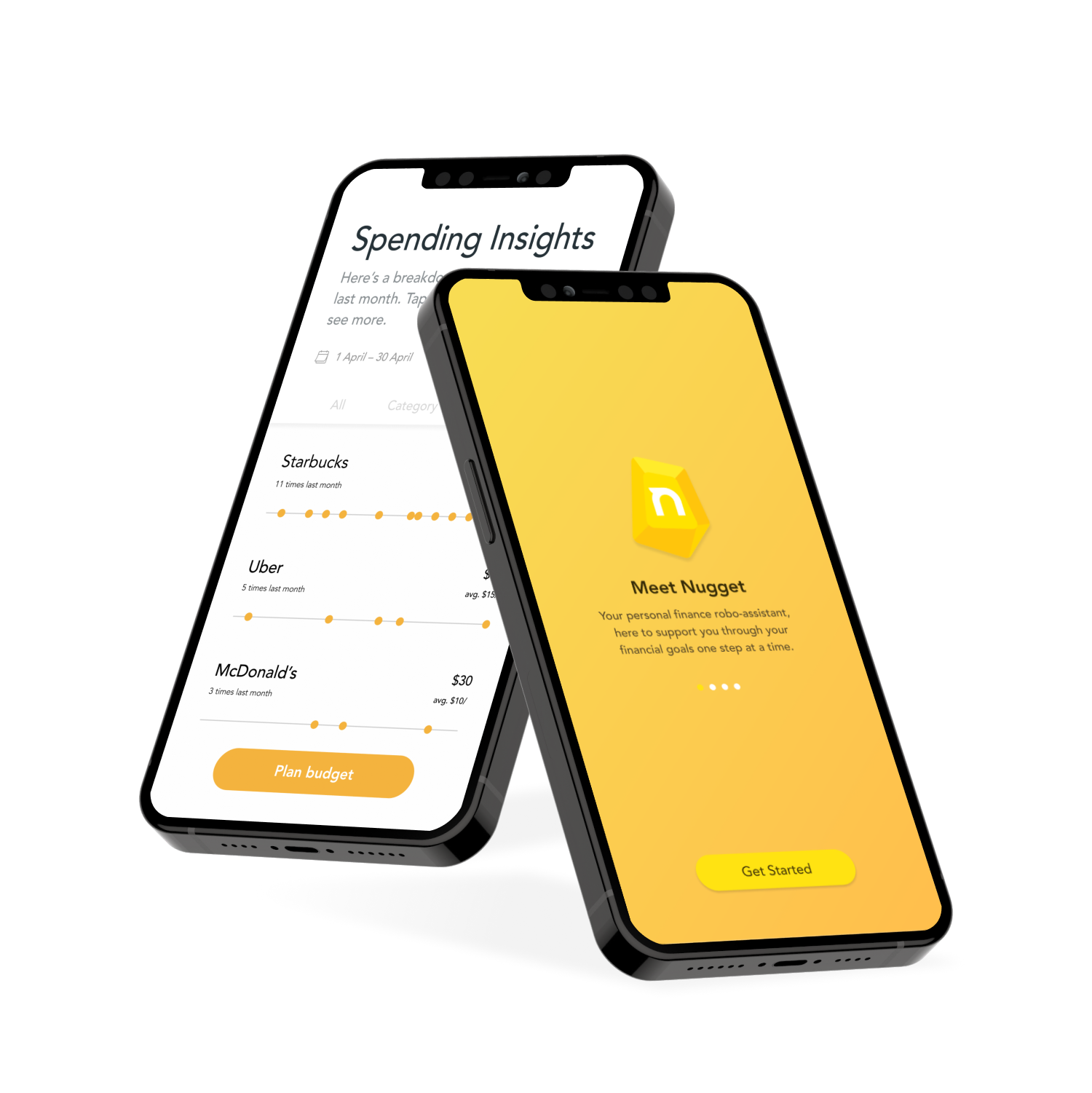

Nugget is a personal finance app that takes human behaviour into consideration to help people create realistic goals and achieve them using habit-forming techniques.

Despite a ton of budgeting apps out on the market, most are just trackers and few are actively helping users to actually improve their financial health.

Nugget is a personal finance app that takes human behaviour into consideration to help people create realistic goals and achieve them using habit-forming techniques.

Despite a ton of budgeting apps out on the market, most are just trackers and few are actively helping users to actually improve their financial health.

Nugget is a personal finance app that takes human behaviour into consideration to help people create realistic goals and achieve them using habit-forming techniques.

Despite a ton of budgeting apps out on the market, most are just trackers and few are actively helping users to actually improve their financial health.

Nugget is a personal finance app that takes human behaviour into consideration to help people create realistic goals and achieve them using habit-forming techniques.

Despite a ton of budgeting apps out on the market, most are just trackers and few are actively helping users to actually improve their financial health.

Nugget is a personal finance app that takes human behaviour into consideration to help people create realistic goals and achieve them using habit-forming techniques.

The way we save and spend our money is rooted in many underlying psychological factors and personal habits.

Getting to know our users

Getting to know

our users

Getting to know

our users

Getting to know our users

Getting to know

our users

Qualitative sessions: 10 participants

Quantitative survey: ~100 participants

Qualitative sessions: 10 participants

Quantitative survey: ~100 participants

Qualitative sessions: 10 participants

Quantitative survey: ~100 participants

Qualitative sessions: 10 participants

Quantitative survey: ~100 participants

Qualitative sessions: 10 participants

Quantitative survey: ~100 participants

Working adults

Aged between 20–40 years old with a stable income, have financial goals, and pay attention to their budget and expenditures.

Less than 100k in savings

In the process of accumulating wealth and mindful of both small and big-ticket expenses.

Common questions from users

Common questions

from users

Common questions

from users

when opening their budgeting application

Literary Research

To change habits, we have to first understand habits better.

Our team turned to these non-fiction books to learn the most effective ways of forming positive habits. The principles from these books should also translate to improving our financial habits.

For example, one of the guiding principles of Atomic Habits which we referenced heavily was The Four Laws of Behaviour Change:

🏷️ Make it obvious

🏷️ Make it attractive

🏷️ Make it easy

🏷️ Make it satisfying

To change habits, we have to first understand habits better.

Our team turned to these non-fiction books to learn the most effective ways of forming positive habits. The principles from these books should also translate to improving our financial habits.

For example, one of the guiding principles of Atomic Habits which we referenced heavily was The Four Laws of Behaviour Change:

🏷️ Make it obvious

🏷️ Make it attractive

🏷️ Make it easy

🏷️ Make it satisfying

To change habits, we have to first understand habits better.

Our team turned to these non-fiction books to learn the most effective ways of forming positive habits. The principles from these books should also translate to improving our financial habits.

For example, one of the guiding principles of Atomic Habits which we referenced heavily was The Four Laws of Behaviour Change:

🏷️ Make it obvious

🏷️ Make it attractive

🏷️ Make it easy

🏷️ Make it satisfying

Designing a solution

Develop & Build

Designing a solution

Designing a solution

Here are all the key features we wanted to focus on, with insights from research methods above.

Here are all the key features we wanted to focus on, with insights from research methods above.

Bank account sync

Convenience of tracking expenses in one place

(make it easy)

Personalised insights

Finding patterns to help improve spending habits

(make it obvious)

Goal-based savings

Breaking down goals into achievable milestones

(make it attractive)

Rewards

Giving them something to look forward to

(make it satisfying)

Giving them something to look

forward to

(make it satisfying)

Giving them something to look forward to

(make it satisfying)

Giving them something to look forward to

(make it satisfying)

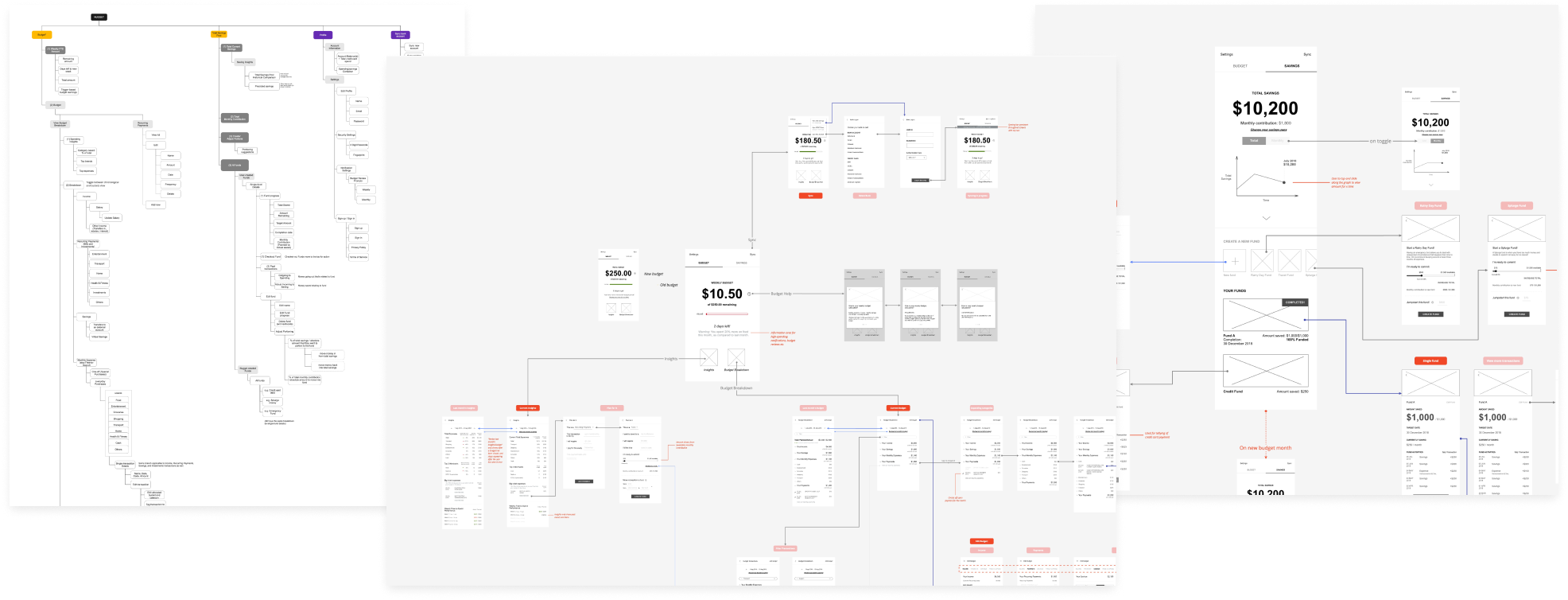

Putting it together

Information architecture was first created, followed by wire-flows based on that. These were then put into a low-fi clickable prototype and went through 2 rounds of testing and iteration to iron out major usability issues.

From left to right: Information architecture, wireflow of budget screen, wireflow of savings screen

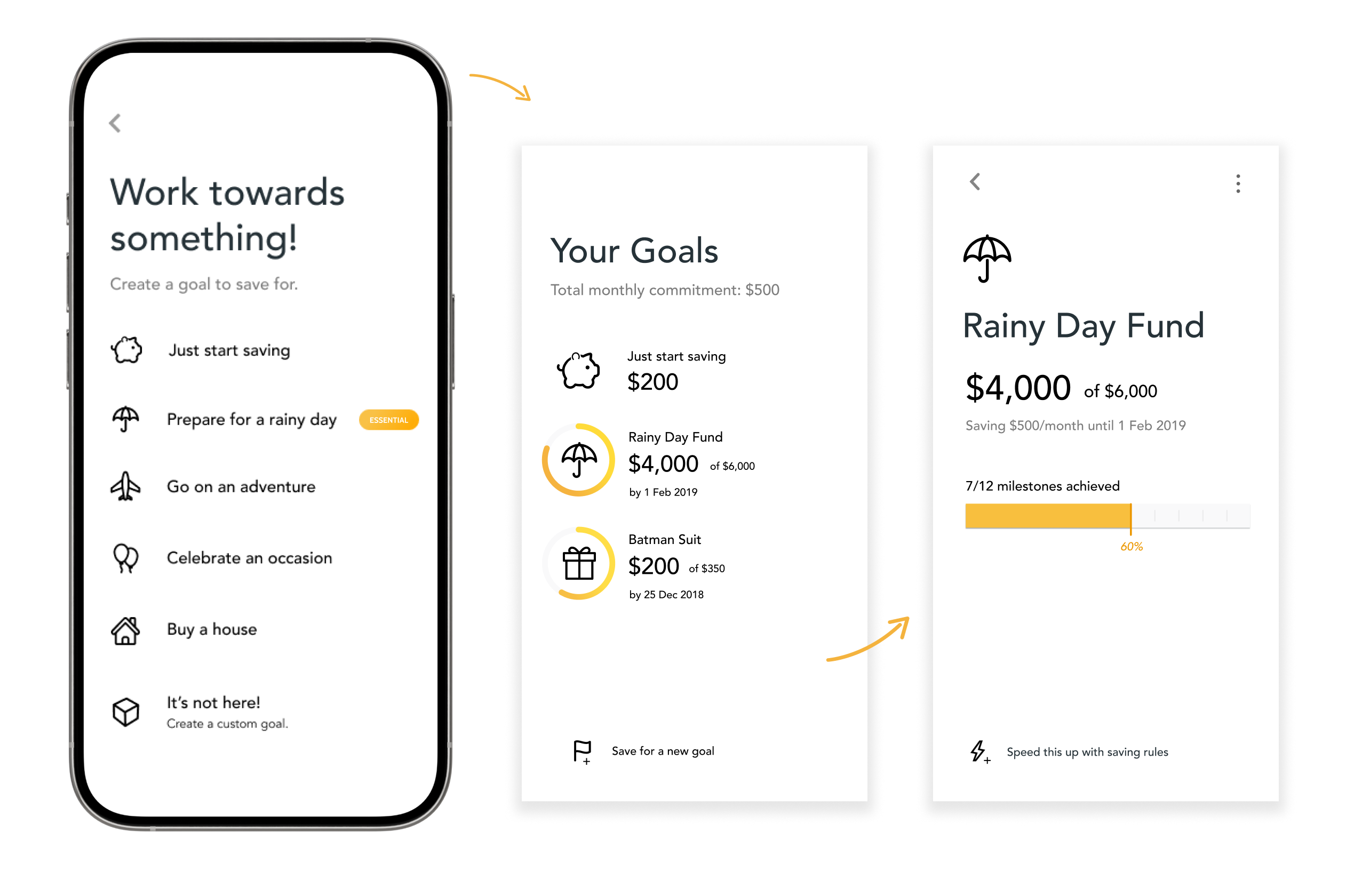

Goal-based savings

Giving users a place to track their goals and monitor its progress meant there was less chance of falling off track. Progression bars were used to help make these goals feel satisfying to follow through.

Important saving goals (like an emergency fund) were also suggested to help users work towards financial independence.

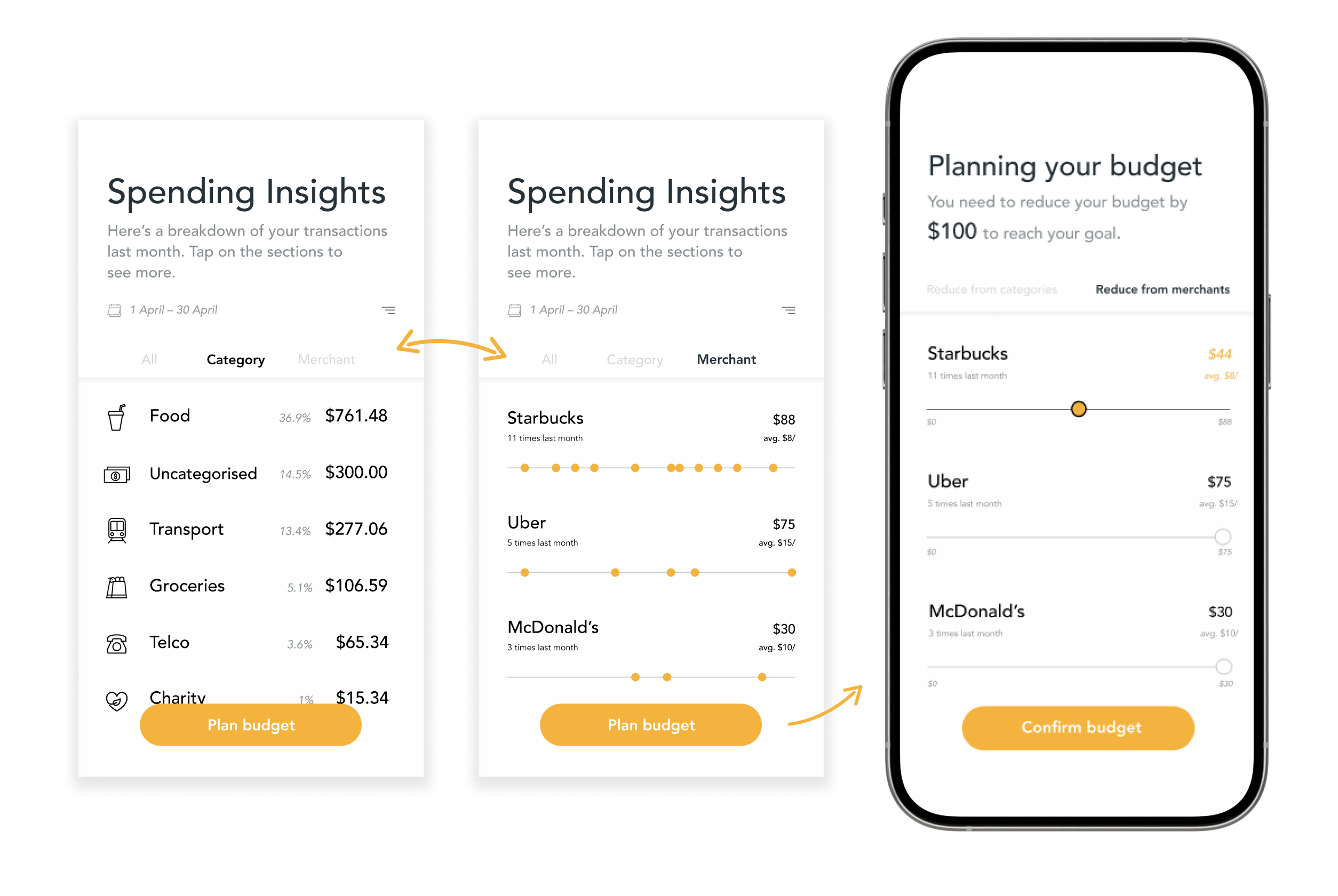

Personalised insights & budget planning

By categorising MCC codes tagged to the transactions synced from the user’s bank statements, Nugget can find correlating monthly data and provide useful insights.

With more clarity on spending patterns, we would then introduce baby steps to help users reduce their highest spending and put these amounts towards their saving goals.

By categorising MCC codes tagged to the transactions synced from the user’s bank statements, Nugget can find correlating monthly data and provide useful insights.

With more clarity on spending patterns, we would then introduce baby steps to help users reduce their highest spending and put these amounts towards their saving goals.

By categorising MCC codes tagged to the transactions synced from the user’s bank statements, Nugget can find correlating monthly data and provide useful insights.

With more clarity on spending patterns, we would then introduce baby steps to help users reduce their highest spending and put these amounts towards their saving goals.

Outcome & Challenges

Outcome & Challenges

Due to time constraints to launch the MVP, minimum time was spent on creating the UI. A few processes I would have loved to run would be looking at data to see how effective these methods were with users by tracking their average amount saved and the app’s user retention rate.

Other features I would introduce, given the opportunity:

1. Partnership with F&B merchants to reward users for achieving saving milestones

2. Push notifications using geo-tagging technology to track merchant spending

i.e. reminding them it’s their 10th cup of coffee at Starbucks

3. A content library to push along the financial empowerment mission and provide guides to improve the user’s financial health and literacy

Due to time constraints to launch the MVP, minimum time was spent on creating the UI. A few processes I would have loved to run would be looking at data to see how effective these methods were with users by tracking their average amount saved and the app’s user retention rate.

Other features I would introduce, given the opportunity:

1. Partnership with F&B merchants to reward users for achieving saving milestones

2. Push notifications using geo-tagging technology to track merchant spending

i.e. reminding them it’s their 10th cup of coffee at Starbucks

3. A content library to push along the financial empowerment mission and provide guides to improve the user’s financial health and literacy

Due to time constraints to launch the MVP, minimum time was spent on creating the UI. A few processes I would have loved to run would be looking at data to see how effective these methods were with users by tracking their average amount saved and the app’s user retention rate.

Other features I would introduce, given the opportunity:

1. Partnership with F&B merchants to reward users for achieving saving milestones

2. Push notifications using geo-tagging technology to track merchant spending

i.e. reminding them it’s their 10th cup of coffee at Starbucks

3. A content library to push along the financial empowerment mission and provide guides to improve the user’s financial health and literacy

Due to time constraints to launch the MVP, minimum time was spent on creating the UI. A few processes I would have loved to run would be looking at data to see how effective these methods were with users by tracking their average amount saved and the app’s user retention rate.

Other features I would introduce, given the opportunity:

1. Partnership with F&B merchants to reward users for achieving saving milestones

2. Push notifications using geo-tagging technology to track merchant spending

i.e. reminding them it’s their 10th cup of coffee this week at the fancy cafe

3. A content library to push along the financial empowerment mission and provide guides to improve the user’s financial health and literacy