JB

JB

JB

JB

JB

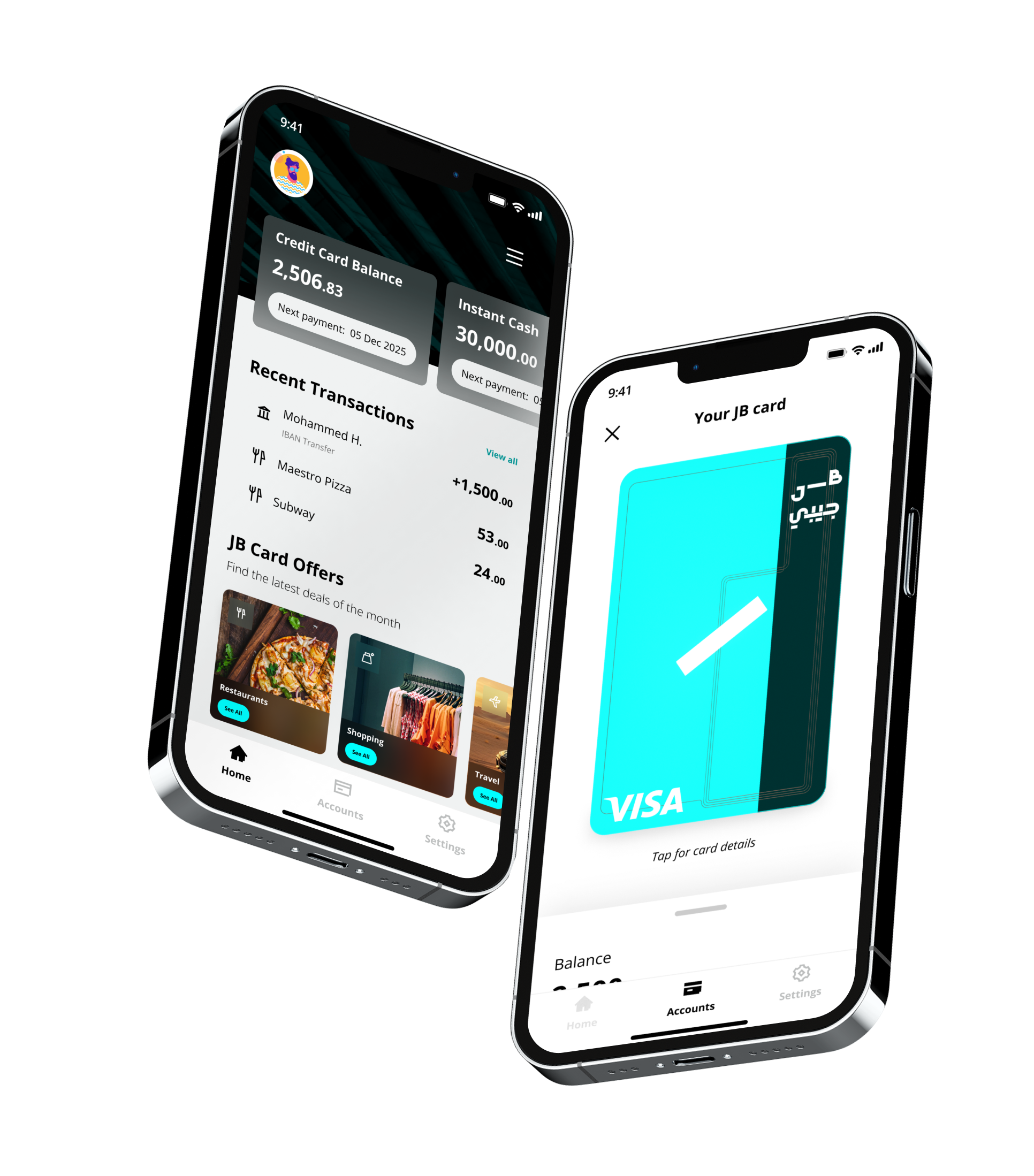

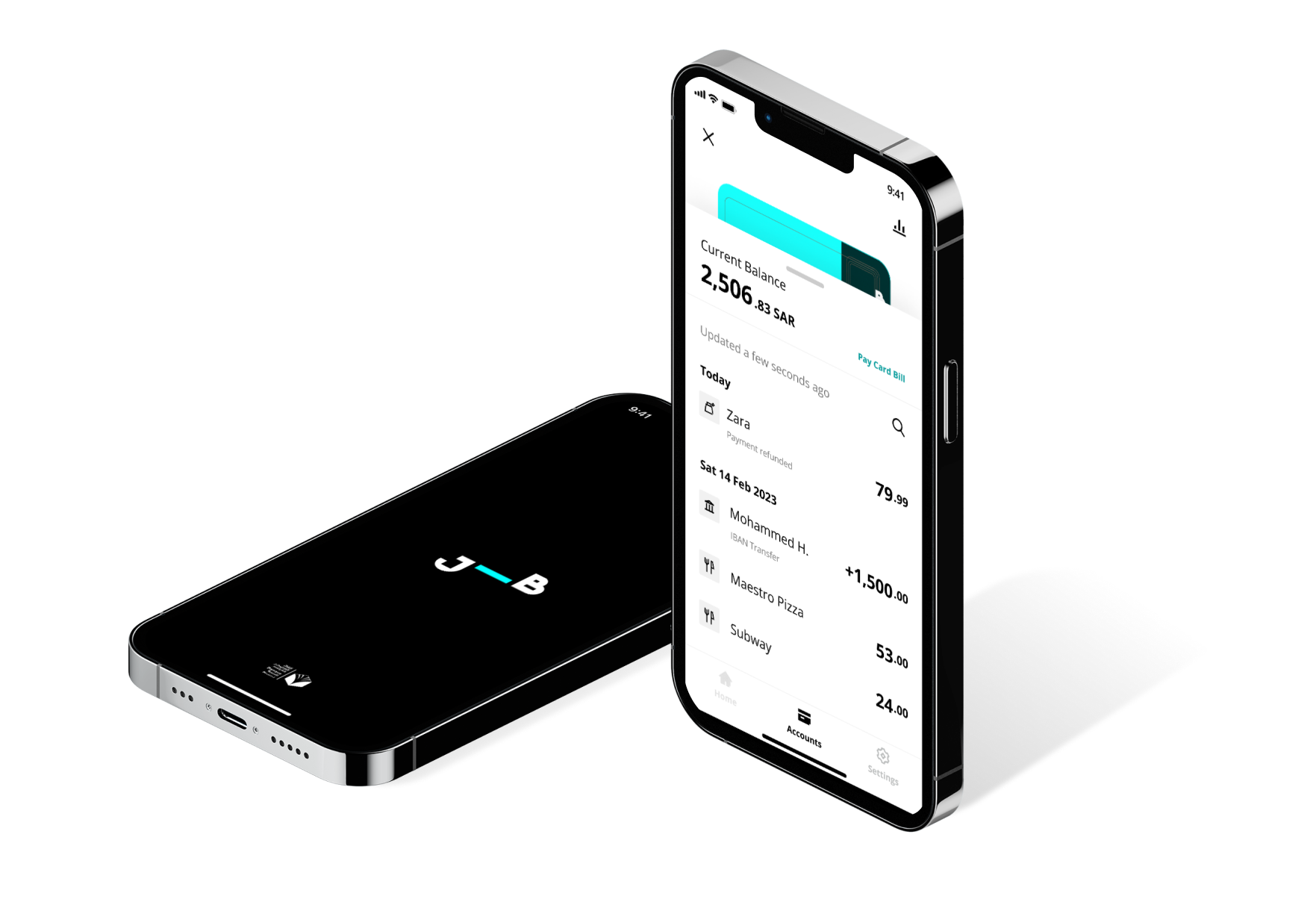

JB is a digital banking app designed for working adults in Saudi Arabia, addressing their need for flexible financing. Previously, customers could only apply for credit facilities in-person with physical documents and pay for it through traditional money transfer methods. With JB, they can apply for various loans, manage them, and access member benefits all within the app.

JB is a digital banking app designed for working adults in Saudi Arabia, addressing their need for flexible financing. Previously, customers could only apply for credit facilities in-person with physical documents and pay for it through traditional money transfer methods. With JB, they can apply for various loans, manage them, and access member benefits all within the app.

JB is a digital banking app designed for working adults in Saudi Arabia, addressing their need for flexible financing. Previously, customers could only apply for credit facilities in-person with physical documents and pay for it through traditional money transfer methods. With JB, they can apply for various loans, manage them, and access member benefits all within the app.

JB is a digital banking app designed for working adults in Saudi Arabia, addressing their need for flexible financing. Previously, customers could only apply for credit facilities in-person with physical documents and pay for it through traditional money transfer methods. With JB, they can apply for various loans, manage them, and access member benefits all within the app.

JB is a digital banking app designed for working adults in Saudi Arabia, addressing their need for flexible financing. Previously, customers could only apply for credit facilities in-person with physical documents and pay for it through traditional money transfer methods. With JB, they can apply for various loans, manage them, and access member benefits all within the app.

Business objective

Business objective

Business objective

Business objective

Business objective

Digitise the application process for financing products while complying with local financial regulations (SAMA).

Digitise the application process for financing products while complying with local financial regulations (SAMA)

Digitise the application process for financing products while complying with local financial regulations (SAMA)

Digitise the application process for financing products while complying with local financial regulations (SAMA)

Digitise the application process for financing products while complying with local financial regulations (SAMA)

Role:

• UX Design Lead, supported by 3 designers

• Lead user research and creative direction

• Support product strategy through research findings

Role:

• UX Design Lead, supported by 3 designers

• Lead user research and creative direction

• Support product strategy through research findings

Role:

• UX Design Lead, supported by 3 designers

• Lead user research and creative direction

• Support product strategy through research findings

Role:

• UX Design Lead, supported by 3 designers

• Lead user research and creative direction

• Support product strategy through research findings

Role:

• UX Design Lead, supported by 3 designers

• Lead user research and creative direction

• Support product strategy through research findings

Key Output:

• User research data

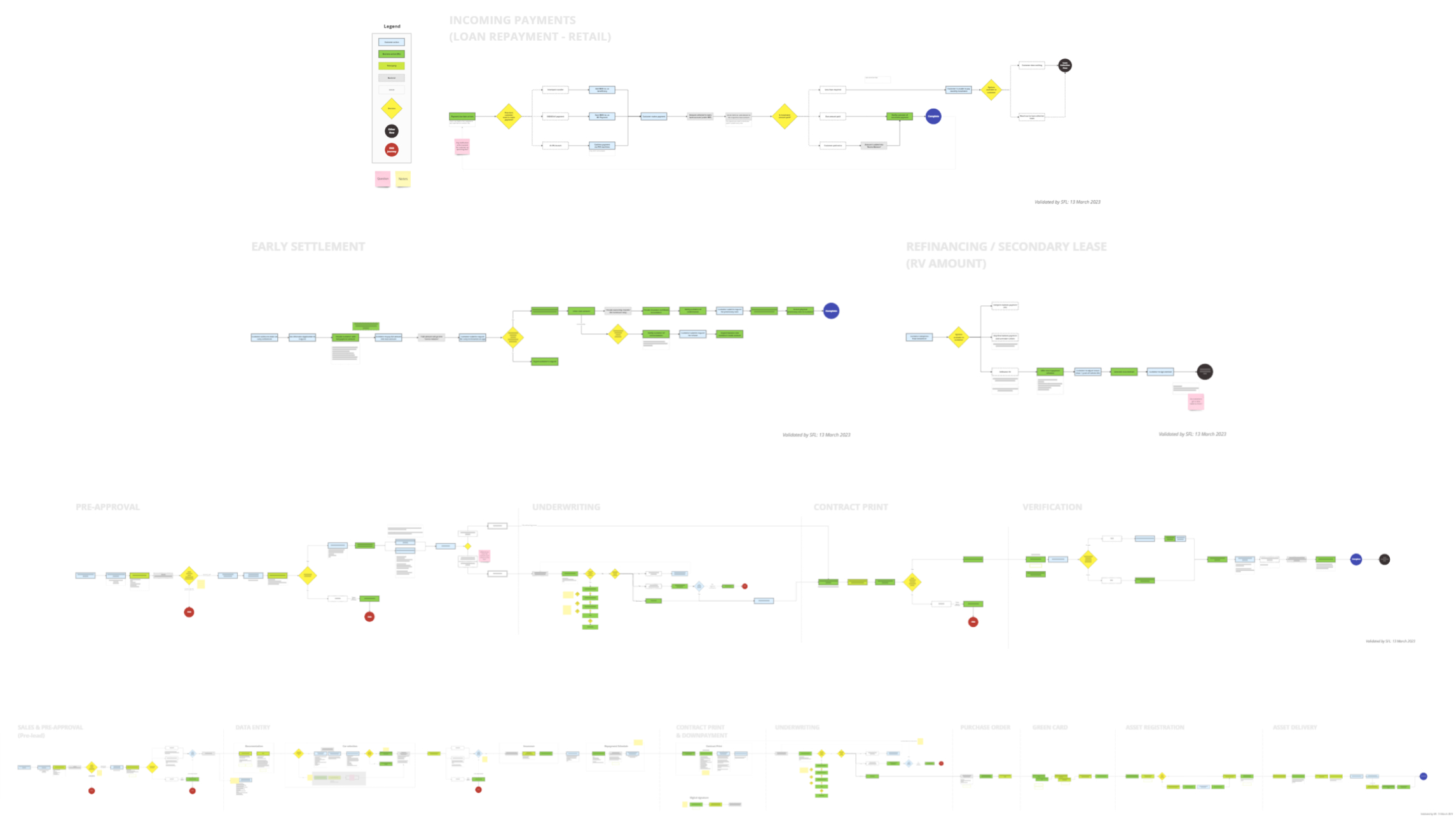

• Analysis and mapping of existing processes

• Digital app flow and wireframes

• Work with engineers to ensure build quality

Key Output:

• User research data

• Analysis and mapping of existing processes

• Digital app flow and wireframes

• Work with engineers to ensure build quality

Key Output:

• User research data

• Analysis and mapping of existing processes

• Digital app flow and wireframes

• Work with engineers to ensure build quality

Key Output:

• User research data

• Analysis and mapping of existing processes

• Digital app flow and wireframes

• Work with engineers to ensure build quality

Key Output:

• User research data

• Analysis and mapping of existing processes

• Digital app flow and wireframes

• Work with engineers to ensure build quality

Analysing existing processes

Analysing existing processes

Analysing existing processes

Analysing existing processes

Analysing existing processes

I interviewed stakeholders and branch managers over two weeks to fully understand the systems, documentation, and dependencies of the existing process. The result was an extensive end-to-end business flow that served as a blueprint for five separate product teams working on the project.

I interviewed stakeholders and branch managers over two weeks to fully understand the systems, documentation, and dependencies of the existing process. The result was an extensive end-to-end business flow that served as a blueprint for five separate product teams working on the project.

I interviewed stakeholders and branch managers over two weeks to fully understand the systems, documentation, and dependencies of the existing process. The result was an extensive end-to-end business flow that served as a blueprint for five separate product teams working on the project.

I interviewed stakeholders and branch managers over two weeks to fully understand the systems, documentation, and dependencies of the existing process. The result was an extensive end-to-end business flow that served as a blueprint for five separate product teams working on the project.

I interviewed stakeholders and branch managers over two weeks to fully understand the systems, documentation, and dependencies of the existing process. The result was an extensive end-to-end business flow that served as a blueprint for five separate product teams working on the project.

Understanding local needs & behaviours

Understanding local needs & behaviours

Understanding local needs & behaviours

Understanding local needs & behaviours

Understanding local needs & behaviours

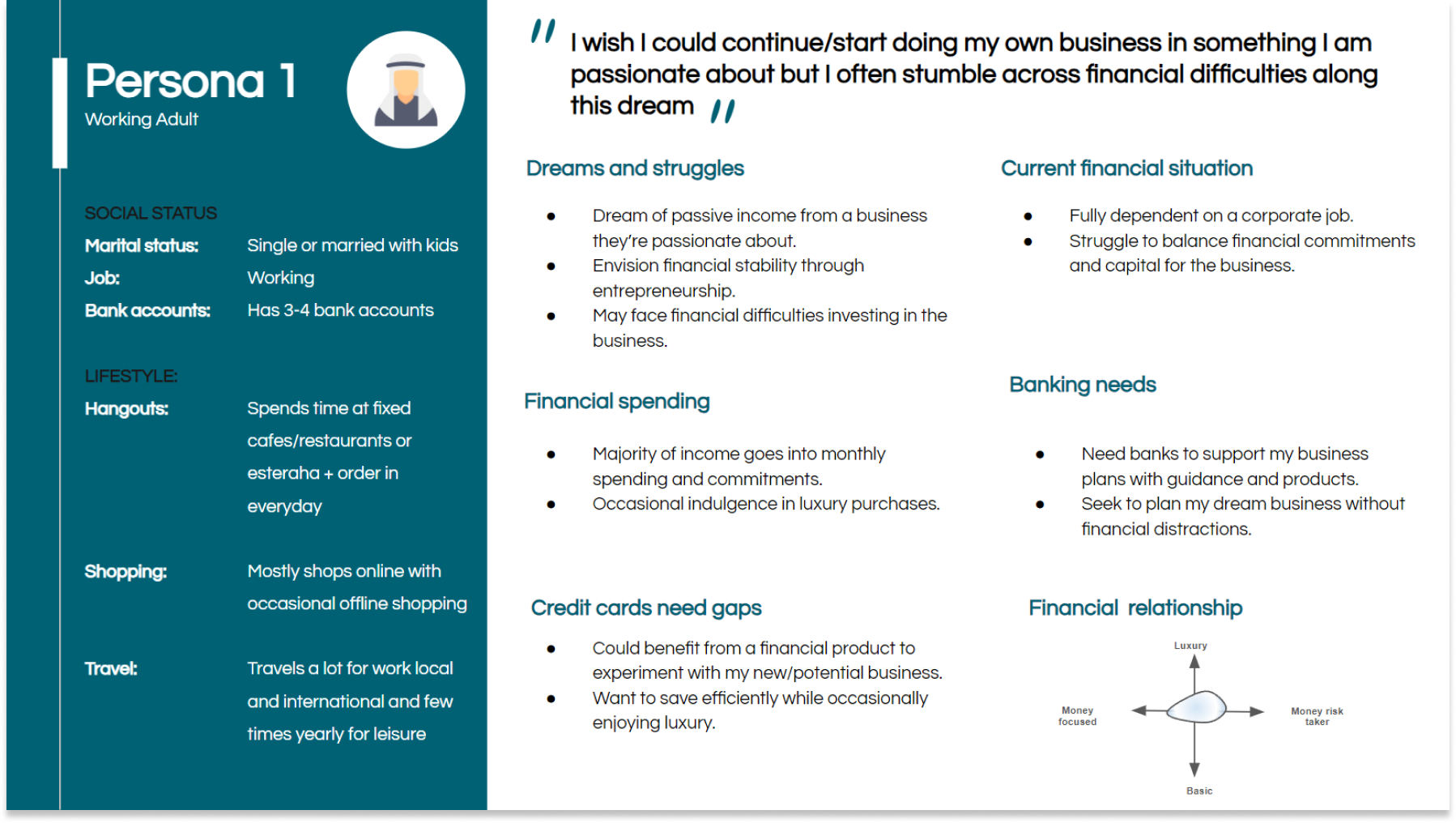

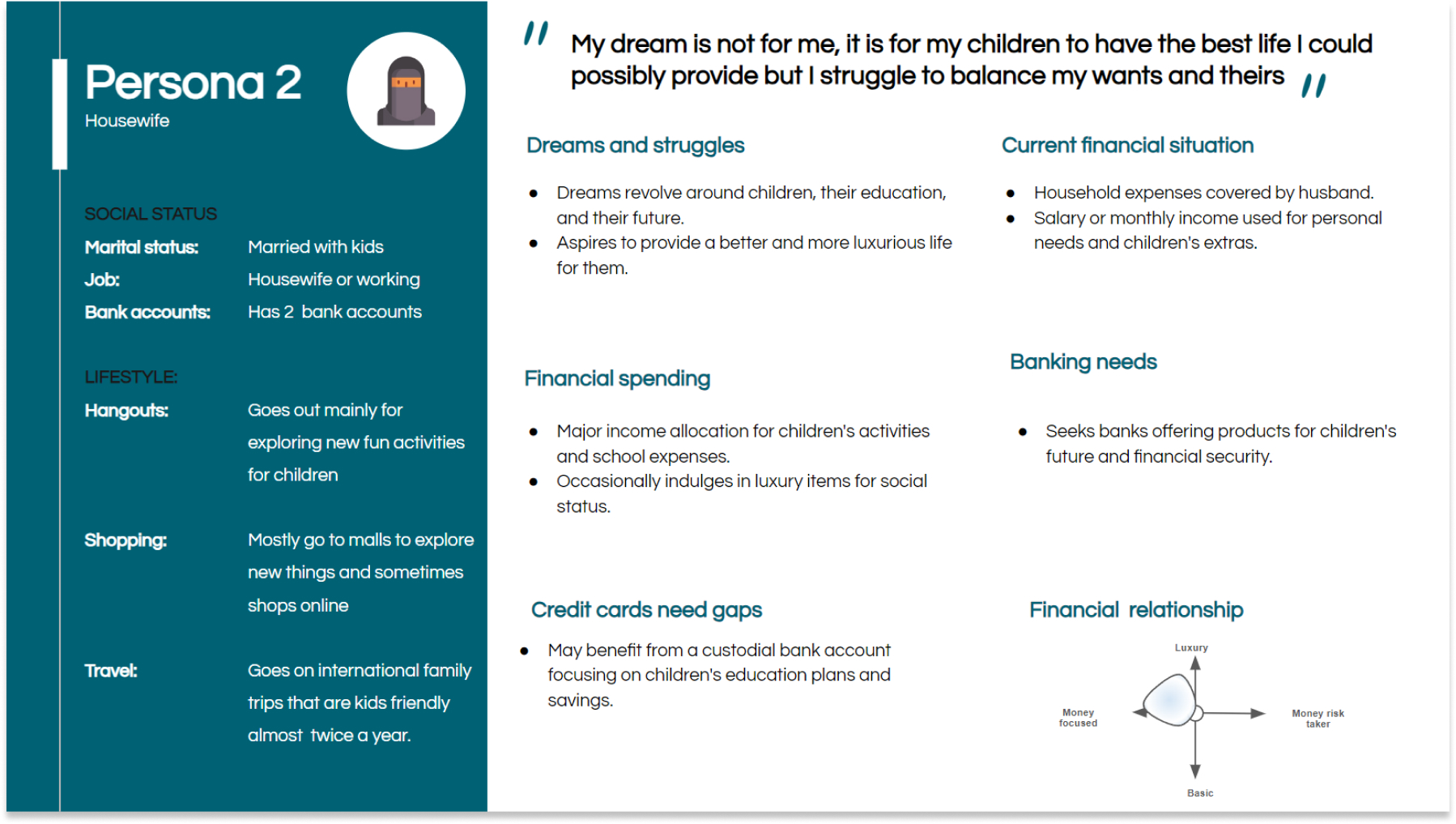

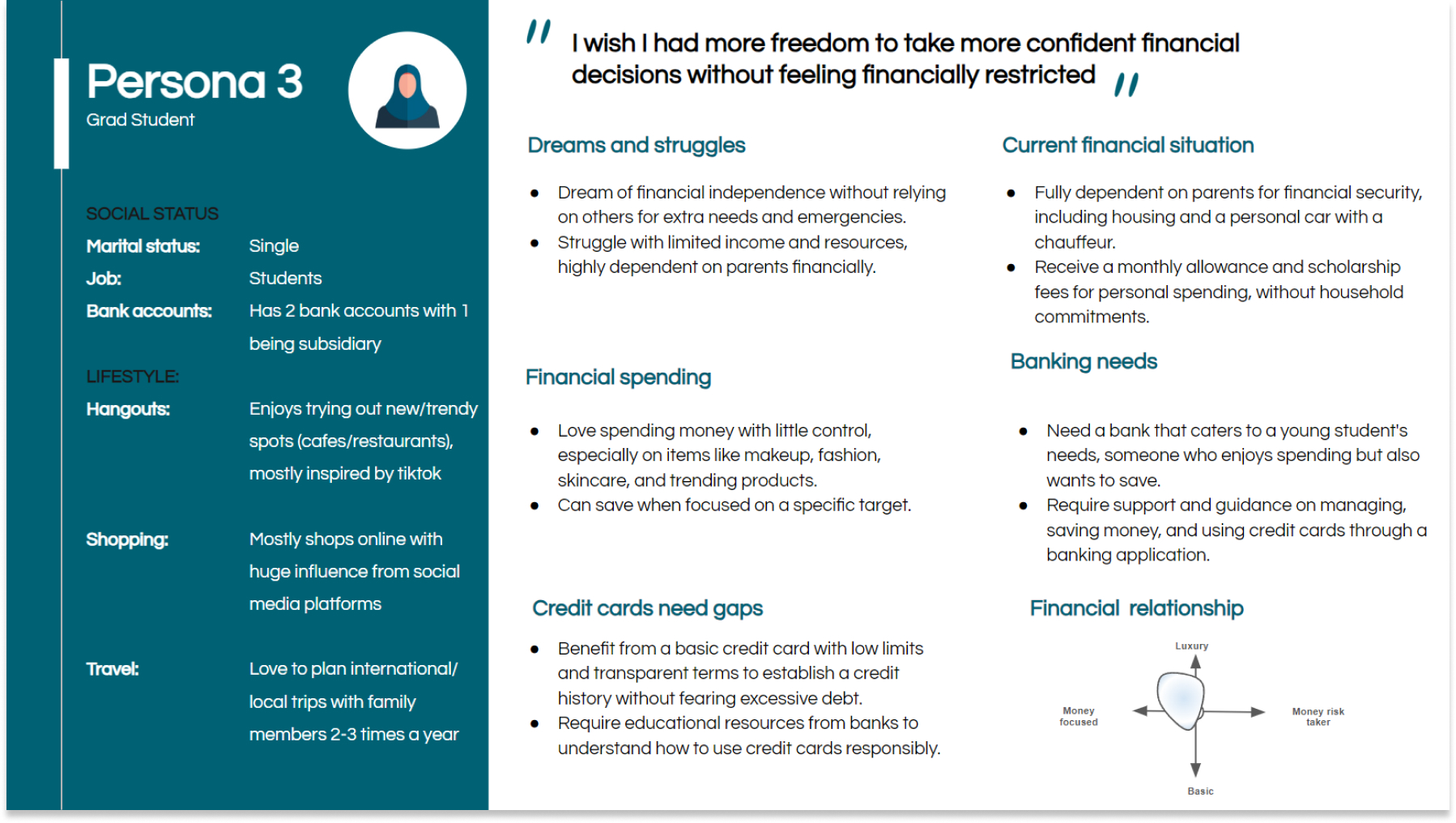

We conducted qualitative interviews in Arabic with 10 local participants who met our screening criteria. The responses were validated through quantitative survey input from 200 participants.

Based on the data, we crafted three key personas to guide our designs:

We conducted qualitative interviews in Arabic with 10 local participants who met our screening criteria. The responses were validated through quantitative survey input from 200 participants.

Based on the data, we crafted three key personas to guide our designs:

We conducted qualitative interviews in Arabic with 10 local participants who met our screening criteria. The responses were validated through quantitative survey input from 200 participants.

Based on the data, we crafted three key personas to guide our designs:

We conducted qualitative interviews in Arabic with 10 local participants who met our screening criteria. The responses were validated through quantitative survey input from 200 participants.

Based on the data, we crafted three key personas to guide our designs:

We conducted qualitative interviews in Arabic with 10 local participants who met our screening criteria. The responses were validated through quantitative survey input from 200 participants.

Based on the data, we crafted three key personas to guide our designs:

Building the app structure

Building the app structure

Building the app structure

Building the app structure

Building the app structure

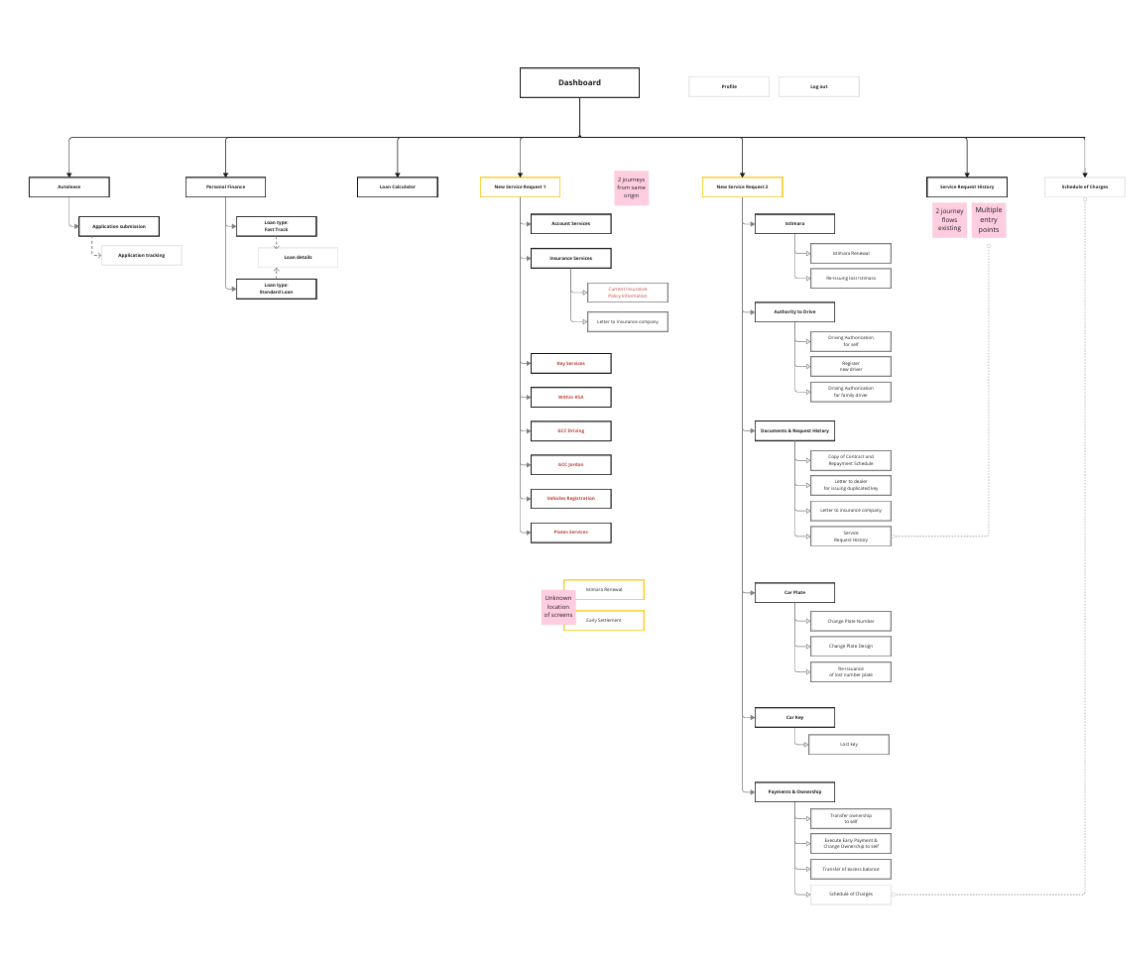

Features for the financing app were informed by our research and flow, then organised into the information architecture.

Once these were signed off, we began designing the app.

Features for the financing app were informed by our research and flow, then organised into the information architecture.

Once these were signed off, we began designing the app.

Features for the financing app were informed by our research and flow, then organised into the information architecture.

Once these were signed off, we began designing the app.

Features for the financing app were informed by our research and flow, then organised into the information architecture.

Once these were signed off, we began designing the app.

Features for the financing app were informed by our research and flow, then organised into the information architecture.

Once these were signed off, we began designing the app.

Outcome

Outcome

Outcome

Outcome

Outcome

Here are some key outcomes from this project:

• Launched JB on Google Play and Apple App Store.

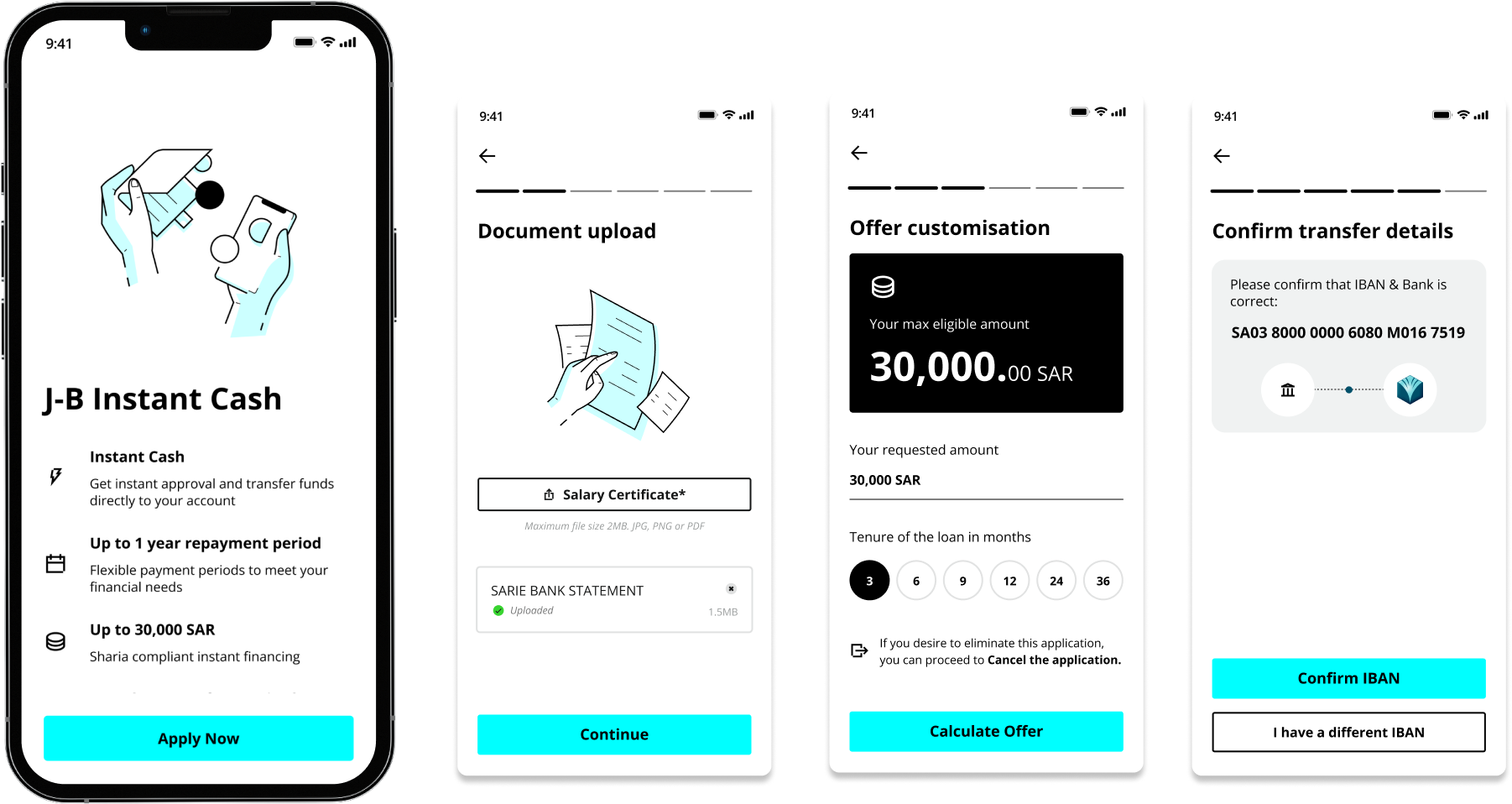

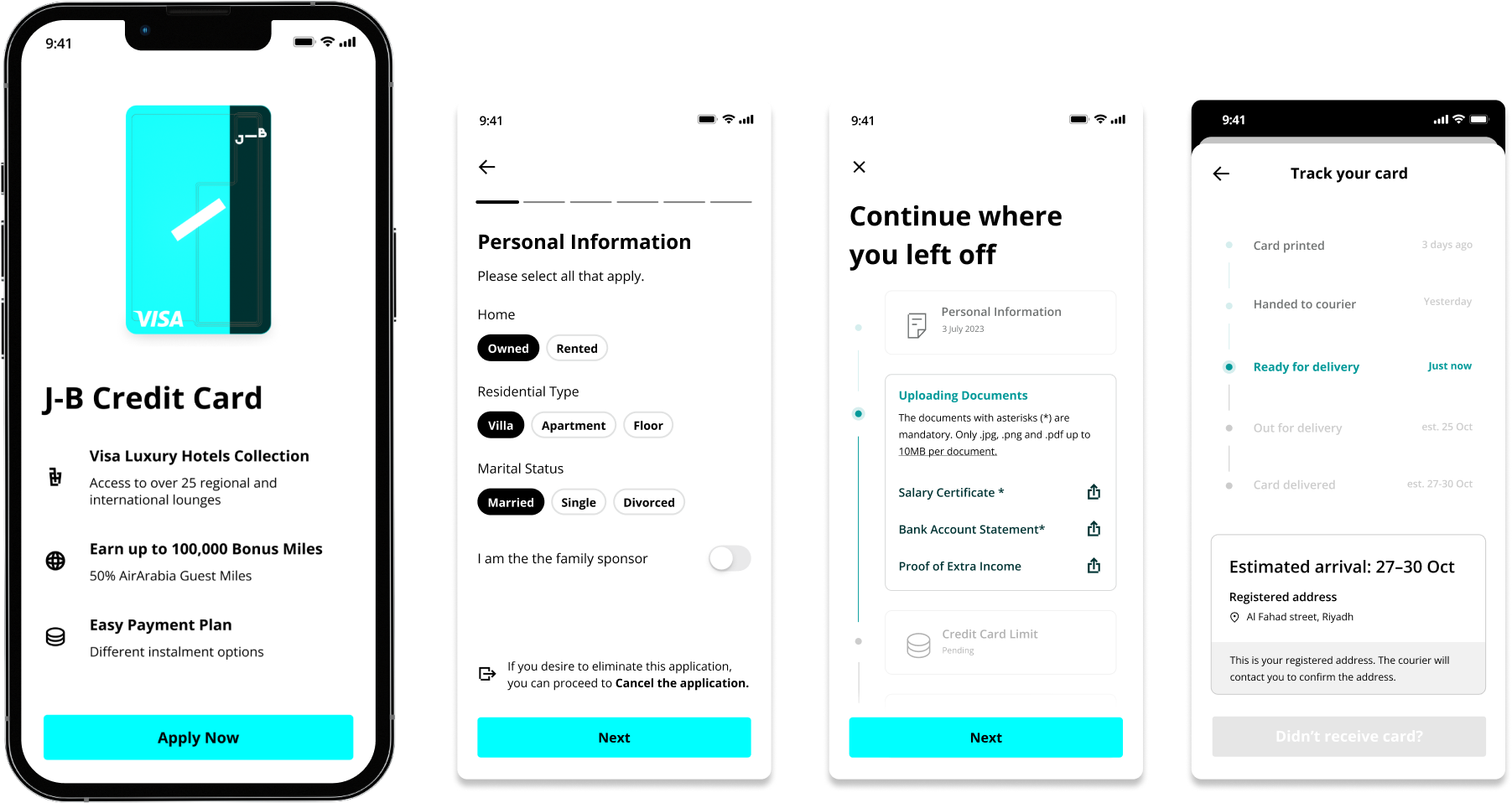

• Successfully digitised personal finance loan and credit card application processes.

• Optimised the personal financing application process, increasing completed sign-ups by 10% (approx. 26,000 users) within one month ⬆️

• Improved the information architecture of a new credit card product, reducing user task completion time by 40% ⬆️

Here are some key outcomes from this project:

• Launched JB on Google Play and Apple App Store.

• Successfully digitised personal finance loan and credit card application processes.

• Optimised the personal financing application process, increasing completed sign-ups by 10% (approx. 26,000 users) within one month ⬆️

• Improved the information architecture of a new credit card product, reducing user task completion time by 40% ⬆️

Here are some key outcomes from this project:

• Launched JB on Google Play and Apple App Store.

• Successfully digitised personal finance loan and credit card application processes.

• Optimised the personal financing application process, increasing completed sign-ups by 10% (approx. 26,000 users) within one month ⬆️

• Improved the information architecture of a new credit card product, reducing user task completion time by 40% ⬆️

Here are some key outcomes from this project:

• Launched JB on Google Play and Apple App Store.

• Successfully digitised personal finance loan and credit card application processes.

• Optimised the personal financing application process, increasing completed sign-ups by 10% (approx. 26,000 users) within one month ⬆️

• Improved the information architecture of a new credit card product, reducing user task completion time by 40% ⬆️

Here are some key outcomes from this project:

• Launched JB on Google Play and Apple App Store.

• Successfully digitised personal finance loan and credit card application processes.

• Optimised the personal financing application process, increasing completed sign-ups by 10% (approx. 26,000 users) within one month ⬆️

• Improved the information architecture of a new credit card product, reducing user task completion time by 40% ⬆️